FILE - President Joe Biden signs the American Rescue Plan, a coronavirus relief package, in the Oval Office of the White House, March 11, 2021, in Washington. Federal officials estimate that local governments now have spending plans in place for most of the money they received under a prominent pandemic relief law. In some cases, it's hard to know exactly how the money is being used, because some governments haven't supplied details about their projects. (AP Photo/Andrew Harnik, File)

From the $1,400 direct payments and the expanded child tax credit in 2021 to ongoing funding for education, healthcare, and housing, the American Rescue Plan played a key role in helping Nevada recover from the pandemic.

This week marks three years since President Joe Biden signed the American Rescue Plan Act (ARPA), a bill designed to jumpstart economic recovery as America reeled from the COVID-19 pandemic. Since March 11, 2021, billions of dollars in federal aid have been distributed to communities across Nevada and throughout the country.

To date, ARPA has allocated $6.3 billion to the state of Nevada, a whopping $1.2 billion of which was designated for K-12 education. Other prioritized sectors included family assistance, housing, transportation, healthcare, higher education, and food assistance. Las Vegas alone received $130.6 million in funding through the act.

Three years later, how have these funds been spent?

More than 1.6 million Nevadans received direct payments of $1,400 under Biden’s COVID relief law.

With its federal funding, the Nevada Department of Education emphasized supporting teachers and encouraging young people to pursue teaching as a career. Through the Incentivizing Pathways to Teach (IPT) Grant Program, over 3,400 aspiring Nevada educators qualified for tuition assistance and stipends to support them during schooling and student teaching.

While Nevada’s teacher shortage has improved since the 2021-2022 school year—when schools reported an overall 12.5% vacancy rate for employees—it still sat at 9.6% at the conclusion of the 2022-2023 school year.

In the Clark County School District, a teacher strike and school board turmoil continue to cause uncertainty for parents and students despite the district reportedly allocating nearly all of its ARPA funding as of December 2023.

In Las Vegas, affordable housing has taken center stage, with the city allocating $26 million to address the housing crisis and fund programs targeted at ending homelessness. Housing is a particularly pressing issue for veterans in Clark County. According to an Annual Homelessness Assessment Report from the Department of Housing and Urban Development (HUD), Las Vegas was the city with the second highest number of homeless veterans in 2023.

A Recovery Plan report from the City of Las Vegas points to the Desert Pines Affordable Housing Development and expansion of the Courtyard Homeless Resource Center as evidence of ARPA’s positive impact in the area.

The Desert Pines project will provide more than 1,800 units of market rate housing on the 100-acre site of the Desert Pines golf course. The Courtyard, which provides services to more than 6,500 people annually, unveiled an outdoor sleeping area in 2022 with covered space for 800 guests and will use ARPA funds to open a full-service medical center.

Nevada homeowners and renters have also benefited from ARPA, with the law providing $121 million in mortgage assistance and more than $164 million in rental assistance.

Jobs remain a concern for many Nevadans, as the state’s 5.2% unemployment rate is the highest in the country. Still, this rate has dropped from 8% when the law was passed.

In Las Vegas, the city points to ARPA-funded projects like Ahern Advance Career Training, a commercial driving training program, as progress toward removing employment barriers. The Second Chance Employment Program also provides job training and employment assistance to people experiencing homelessness in Clark County.

In the healthcare sector, Nevadans have seen an average reduction in monthly premiums since the implementation of ARPA, which expanded subsidies for individuals who get health insurance via the Affordable Care Act (ACA) marketplace, making the plans far more affordable.

The law also temporarily expanded the Child Tax Credit from $2,000 per child to $3,000 per child for kids ages 6 and older and $3,600 per child under six. This expansion benefited approximately 594,000 children in Nevada before it expired in 2022. For the 2023 tax year, the IRS says filers may still be eligible for a tax credit in the amount of up to $2,000 per qualifying child, but Biden has repeatedly called on Congress to restore the expanded credit.

“The Child Tax Credit I passed during the pandemic cut taxes for millions of working families and cut child poverty in HALF,” Biden said during last week’s State of the Union address. “Restore the Child Tax Credit because no child should go hungry in this country!”

On Monday, on the third anniversary of the American Rescue Plan, Biden released a new budget proposal, including a request for Congress to restore the more generous child tax credit.

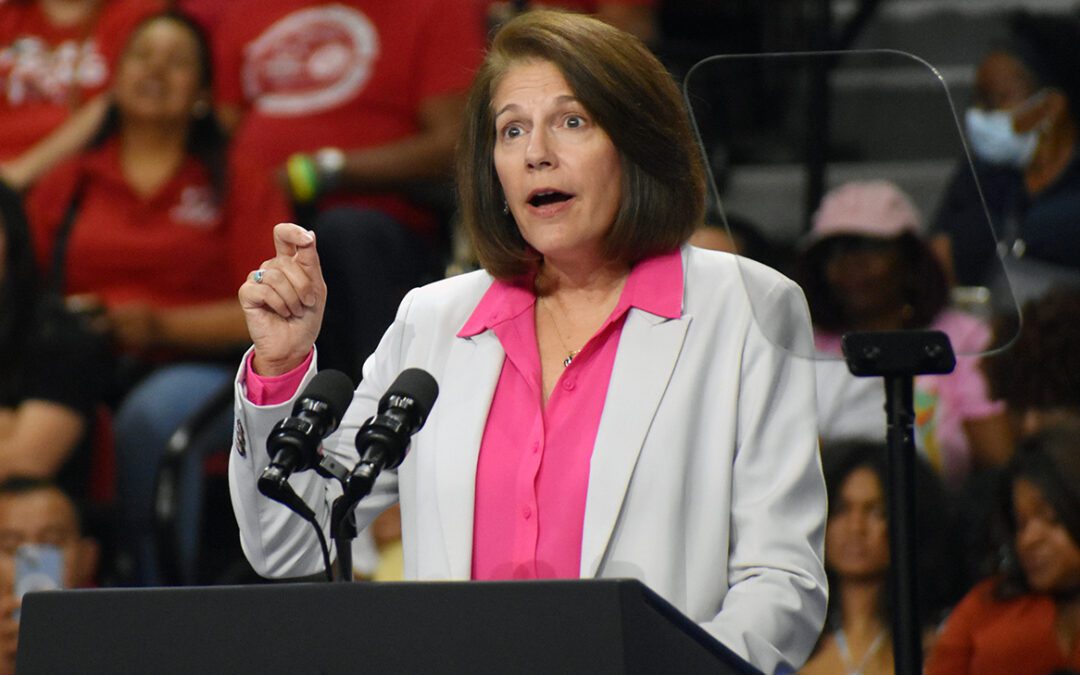

Trump’s plan to gut Medicaid to pay for tax cuts for billionaires ‘would be devastating for Nevadans,’ senator warns

Nevada Democratic US Sen. Catherine Cortez Masto said a Republican plan to cut taxes on the rich can only be offset by about $880 billion in cuts to...

Cortez Masto reintroduces bill to improve access to behavioral health and substance use disorder treatments

Nevada’s senior US Senator says the COMPLETE Care Act would allow primary care clinics to hire mental health professionals — a model that experts...

Discurso de Donald Trump en el Congreso: chequeo en español y resumen de falsedades, afirmaciones sin contexto y verdades

Si sólo tienes unos segundos, lee estas líneas: El presidente Donald Trump divulgó varias desinformaciones en su discurso ante el Congreso. El...

Nevada Democrats bring guests who’ll be impacted by Trump’s funding cuts to Congressional address

Nevada Democrats and others from across the US are using Tuesday night’s event to highlight the negative real-world impacts of the Trump...

What Trump’s order making English the official language in the US could mean

By FERNANDA FIGUEROA Associated Press As President Donald Trump is expected to sign an executive order designating English as the official language...

Rep. Steven Horsford introduces bill to eliminate taxes on tips, abolish subminimum wage

A new proposal from the Democratic congressman seeks to go beyond Trump’s campaign promise of cutting taxes on tips by also eliminating the...