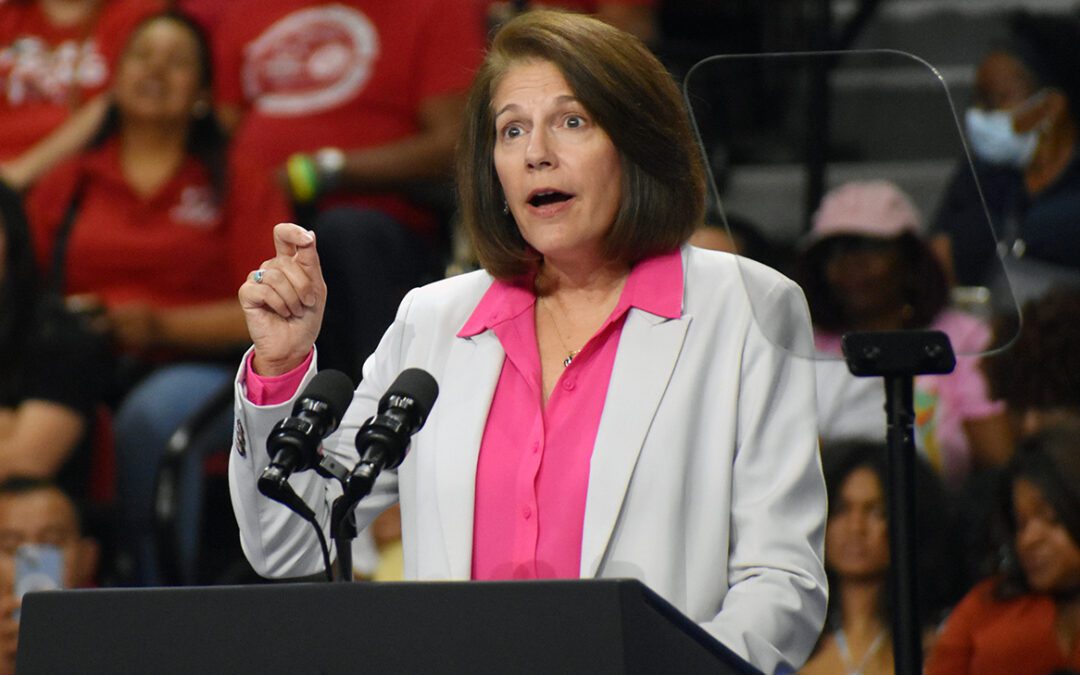

Sen. Catherine Cortez Masto, D-Nev., meets with people near a polling place for an event with Latina community members to vote early, Wednesday, Oct. 30, 2024, in Las Vegas. (AP Photo/John Locher)

Nevada US Sen. Catherine Cortez Masto’s Tax Administration Simplification Act seeks to streamline certain tax processes and eliminate late fees assessed by the IRS due to processing delays on the government’s end.

A new federal proposal seeks to implement a slew of new reforms for individuals and small businesses filing their taxes that lawmakers say will streamline the filing process and eliminate burdensome penalties for taxpayers.

The Tax Administration Simplification Act, introduced Thursday by US Sens. Catherine Cortez Masto (D-Nevada) and Marsha Blackburn (R-Tennessee), seeks to streamline certain tax processes and eliminate late fees assessed by the IRS due to processing delays on the government’s end, the Senators said in a press release.

Under current law, even if taxpayers submit a document on its due date, it may be considered late unless submitted physically. The bill would extend the existing so-called “mailbox rule” to electronically-submitted documents, ensuring documents filed digitally be considered on-time regardless of IRS processing delays. The change would also hopefully protect taxpayers from penalties and potential audits stemming from government lags that are beyond that filer’s control.

Another provision of the bill would create a standardized quarterly deadline for estimated tax payments, which currently requires payments at inconsistent intervals throughout the year, and lawmakers said the hope is moving it to a more regular interval will help taxpayers more easily manage and project their income for tax reporting.

The bill also seeks to allow new business owners to make an “S-Corp” status designation, which provides greater tax flexibility on their first timely-filed tax return, a change from the current status quo in which the deadline to elect a tax status precedes the deadline for a new business’ first income tax return.

“I’ve heard from Nevada small business and workers about the challenges they face when filing their taxes, so I’m fighting to cut burdensome paperwork and streamline this process,” Cortez Masto said in a statement. “This bipartisan legislation makes it easier for Nevadans to file taxes and avoid unnecessary penalties.”

Trump’s plan to gut Medicaid to pay for tax cuts for billionaires ‘would be devastating for Nevadans,’ senator warns

Nevada Democratic US Sen. Catherine Cortez Masto said a Republican plan to cut taxes on the rich can only be offset by about $880 billion in cuts to...

Cortez Masto reintroduces bill to improve access to behavioral health and substance use disorder treatments

Nevada’s senior US Senator says the COMPLETE Care Act would allow primary care clinics to hire mental health professionals — a model that experts...

Discurso de Donald Trump en el Congreso: chequeo en español y resumen de falsedades, afirmaciones sin contexto y verdades

Si sólo tienes unos segundos, lee estas líneas: El presidente Donald Trump divulgó varias desinformaciones en su discurso ante el Congreso. El...

Nevada Democrats bring guests who’ll be impacted by Trump’s funding cuts to Congressional address

Nevada Democrats and others from across the US are using Tuesday night’s event to highlight the negative real-world impacts of the Trump...

What Trump’s order making English the official language in the US could mean

By FERNANDA FIGUEROA Associated Press As President Donald Trump is expected to sign an executive order designating English as the official language...

Rep. Steven Horsford introduces bill to eliminate taxes on tips, abolish subminimum wage

A new proposal from the Democratic congressman seeks to go beyond Trump’s campaign promise of cutting taxes on tips by also eliminating the...