FILE - Sen. Jacky Rosen, D-Nev., listens during a hearing of the Senate Armed Services Subcommittee on Strategic Forces to examine United States Space Force programs in review of the Fiscal Year 2024 Defense Authorization Request, March 14, 2023, in Washington. Rosen announced Monday, March 4, 2024, at a union hall in Las Vegas that she has officially filed for reelection in a presidential battleground state that is a top GOP target in a challenging 2024 Senate map. (AP Photo/Alex Brandon, File)

The First-Time Homebuyer Tax Credit Act would create a point-of-sale tax credit for up to 10% of a home’s purchase price, capped at $15,000.

Dreaming of buying your first home in Nevada, but feeling limited by costs? You’re not alone. For many would-be homeowners, rising housing rates have made monthly mortgage payments feel out-of-reach—let alone lump sum down payments.

According to real estate marketplace Zillow, the average cost of a home for sale in Nevada is $426,267, a 2.3% increase in just the last year. An October 2023 analysis from Redfin also reported that households in Las Vegas needed a six-figure income—at least $113,186 annually—to afford a mortgage, a 15% rise from 2022.

In response to the housing affordability crisis, Senator Jacky Rosen (D-NV) introduced legislation last week that would provide first-time homebuyers with a sizable tax credit to reduce down payment strain and eliminate barriers to homeownership for low- and middle-income Nevadans.

The First-Time Homebuyer Tax Credit Act would create a point-of-sale tax credit for up to 10% of a home’s purchase price, capped at $15,000. For first-time buyers, this credit would help alleviate the stress of a large upfront down payment necessary for mortgage approval.

“Skyrocketing home prices are making it more difficult for hardworking Nevadans to achieve their dream of owning a home,” said Rosen in a press release. “One of the main barriers to homeownership is being able to afford a down payment, and I’m working at the federal level to bring relief to Nevadans.”

RELATED: Biden proposes new actions to address housing shortages and high costs

The First-Time Homebuyer Tax Credit Act wouldn’t be Nevada’s only homeowner assistance program. Low- and moderate-income homebuyers are also eligible for the statewide Home Is Possible program, which provides them with fixed interest 30-year mortgages and other financial benefits.

Some first-time Nevada homeowners and veterans also qualify for the Mortgage Credit Certificate program, which offers a federal income tax credit based on mortgage loan interest.

Rosen, who’s seeking reelection this fall, has a record of backing housing legislation for Nevadans. Last week, she announced that she’d helped Nevada Tribal communities secure more than $1.3 billion in funding for housing as part of a bipartisan package signed into law by Congress.

In January, she introduced the Housing Oversight and Mitigation Exploitation (HOME) Act, a bill designed to prevent corporate investors from price-gouging or buying an excessive amount of real estate and driving up housing costs for everyday Nevadans.

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Nevadans and our future.

Since day one, our goal here at The Nevadan / El Nevadense has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Nevada families—they will be inspired to become civically engaged.

Video: Sen. Jacky Rosen introduces bill to lower costs for first-time Nevada homebuyers

Video: Lombardo tries to pin housing woes on Biden after vetoing bills and naming ex-housing lobbyist as chief of staff

Biden cancels student loan debt for 3,020 more Nevadans

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 3,020...

Video: Visiting Las Vegas, Biden promises lower costs for renters and homeowners

Biden unveils new plan for student debt relief

The Biden-Harris Administration on Monday unveiled new plans to relieve student debt for more than 30 million borrowers. During appearances across...

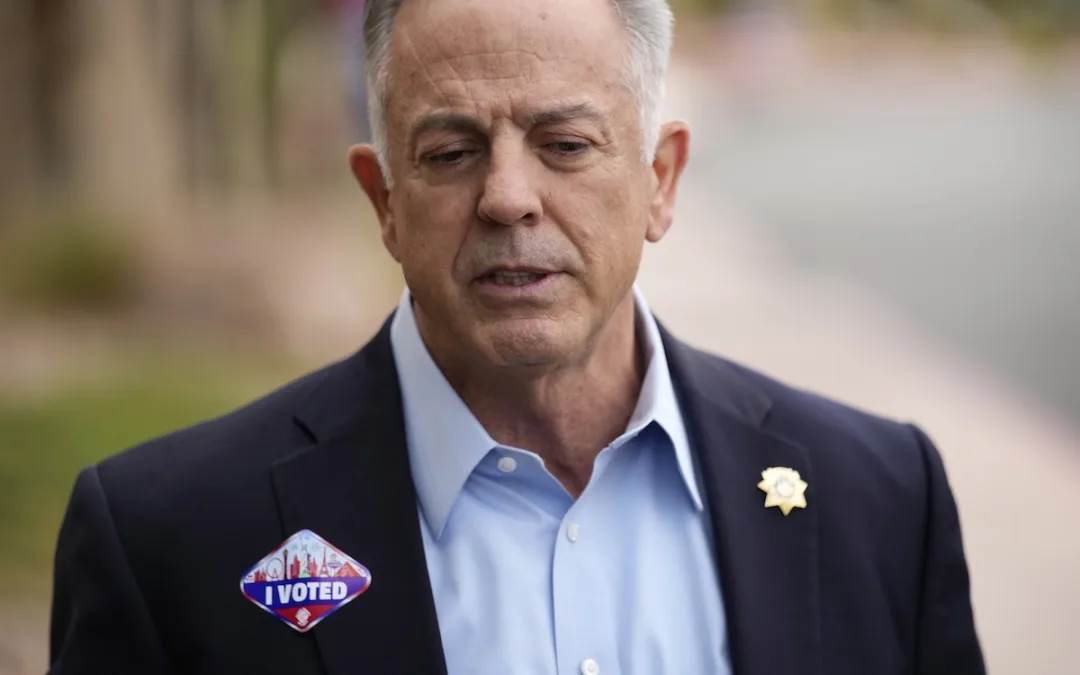

Lombardo tries to pin housing woes on Biden after vetoing bills and naming ex-housing lobbyist as chief of staff

The Nevada Housing Justice Alliance accused the governor of passing off responsibility for the housing crisis to Biden while “foregoing in-state...